Apple Inc, incorporated on January 3, 1977, is a multinational technology company that is listed on the Nasdaq stock exchange since December 1980. Based out of Cupertino, the market capitalization of Apple is $2.07 trillion. Apple's product profile includes iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, while software portfolio comprises iPhone OS , OS X and watchOS operating systems, iCloud and Apple Pay. Apple is also into digital content streaming services -- Apple Music and Apple TV+.For the quarter ended 27 June 2020, Apple earned a revenue of $59.7 billion, an increase of 11 per cent from the year-ago quarter.

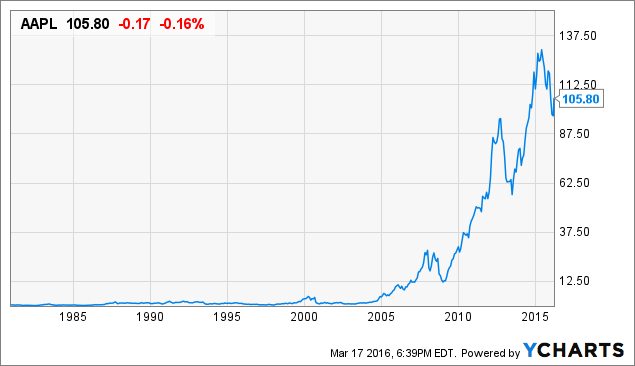

Other major markets for Apple include Europe, India, Middle East, Africa, China and Japan. International sales accounted for 60 percent of the quarter's revenue. Key institutional investors include Fidelity Management & Research Company, Vanguard Group, BlackRock and Berkshire Hathaway.Apple's stock was priced at $22 in its initial public offering on 12 December 1980. If adjusted for stock splits, the share price was about $0.10.In the global smartphone market, Apple has a 14 per cent share while in the PC segment it is at the fourth spot worldwide with 6.7 per cent market share. Read MoreApple Inc, incorporated on January 3, 1977, is a multinational technology company that is listed on the Nasdaq stock exchange since December 1980.

Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company's dividend expressed as a percentage of its current stock price. Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets.

It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California. Apple designs a wide variety of consumer electronic devices, including smartphones , tablets , PCs , smartwatches , AirPods, and TV boxes , among others.

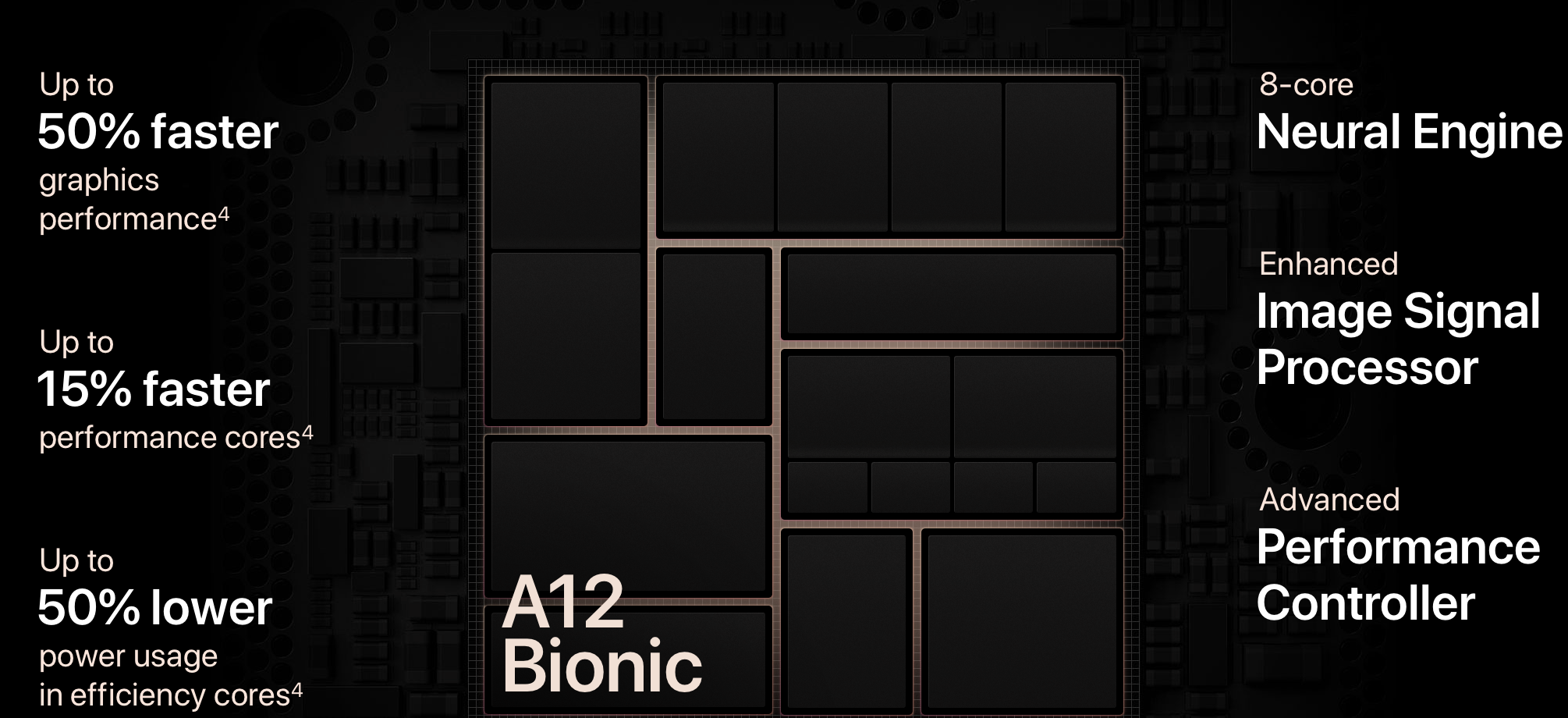

The iPhone makes up the majority of Apple's total revenue. In addition, Apple offers its customers a variety of services such as Apple Music, iCloud, Apple Care, Apple TV+, Apple Arcade, Apple Card, and Apple Pay, among others. Apple's products run internally developed software and semiconductors, and the firm is well known for its integration of hardware, software and services. Apple's products are distributed online as well as through company-owned stores and third-party retailers. Apple Inc. is one of the very few companies that had successfully sensationalised the American stock market since its launch.

Headquartered in Cupertino, California this technological behemoth was co-founded by Steve Jobs, Ronal Wayne and Steve Wozniak in 1976. The company was launched with a view to innovate the field of technology and aimed to create unrivalled products for the lovers of superior experience. Its premium products include iPhones, iPads, Apple Watches, Apple cards, Macs, Apple News+, Apple Pay, and Apple TV+. This is a bundled plan comprising four major Apple services namely, Apple Music, Apple TV+, Apple Arcade, and iCloud. Customers get access to all four against low monthly charges. Among all the advanced gadgets engineered by Apple Inc, iPhones have especially captured attention all around the world and is currently one of the highest selling smartphones.

This company started its business with a single product Apple I, a computer designed and hand-built by Wozniak. To financially support this creation, Jobs sold his Volkswagen Microbus, and Wozniak sold his calculator HP-65. The hard work and sacrifices of the founding members paid off when Apple laid hold of the biggest stock market launch in history after Ford. It kept growing from both technological and financial aspects, and by the beginning of the 21st century, Steve Jobs had become the face of Apple. After his demise, many have criticised the company's products for their lack of innovation, but its market has consistently retained its loyal customer base.

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company's products include iPhone, Mac, iPad, and Wearables, Home and Accessories. IPhone is the Company's line of smartphones based on its iOS operating system. Mac is the Company's line of personal computers based on its macOS operating system.

IPad is the Company's line of multi-purpose tablets based on its iPadOS operating system. Wearables, Home and Accessories includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories. AirPods are the Company's wireless headphones that interact with Siri. Its services include Advertising, AppleCare, Cloud Services, Digital Content and Payment Services. Its customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets. MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis.

IPad is the Company's line of multi-purpose tablets based on its iPadOS... Apple's financial performance, including its share price, relies heavily on the sales of its products. A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion. Apple Inc. is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +25.25% per year. These returns cover a period from January 1, 1988 through December 6, 2021. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Apple stock rose by 0.9% in trading this morning, but closed down 2.1%, at $175.74 per share.

Talk of the $3 trillion mark came as JPMorgan updated its target share price for the company from $180 to $210, citing improved expectations around demand for the iPhone 13. Apple told suppliers earlier this month demand for the new phone had weakened, but iPhone sales in China were up by more than 6% in November compared to the previous year, boosting analysts' confidence in the stock. In a note, JPMorgan analysts wrote they believed Apple's stock was undervalued, and that the company's upcoming iPhone with 5G technology has the potential to convert more than 1 billion Android users. Apple's market cap is calculated by multiplying AAPL's current stock price of $177.57 by AAPL's total outstanding shares of 16,406,397,000. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications,...

JPMorgan Chase predicts that the U.S. stock market rally will continue next year and that no major selloff is insight. According to JPMorgan, investors are too bearish on the market, and that the recent rally in just a few mega-cap stocks doesn't signal a peak in stock prices. Alternatively, assess the AAPL premarket stock price ahead of the market session or view the after hours quote. View the Apple Inc real time stock price chart below to monitor the latest movements.

You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the AAPL quote. When interest rates go up, borrowing becomes more expensive for both consumers and companies. That can hurt profit margins for companies and make stocks less attractive to investors, while sapping consumer demand because people have less money to spend if their mortgage and other loan payments go up. Over time, that tends to deflate the stock market and reduce demand, which brings inflation back under control. APPLE INC - is an American multinational corporation that designs, develops, and sells consumer electronics, computer software and personal computers. Its best-known hardware products are the Mac line of computers, the iPod music player, the iPhone smartphone, and the iPad tablet computer.

The company has 72,800 permanent full-time employees and 3,300 temporary full-time employees worldwide. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. As of January 2022 Apple has a market cap of $2.913 Trillion.

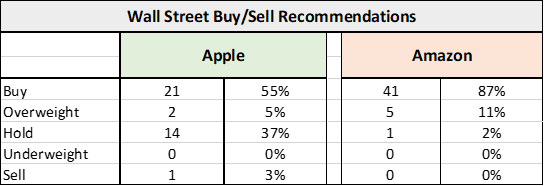

This makes Apple the world's most valuable company by market cap according to our data. The market capitalization, commonly called market cap, is the total market value of a publicly traded company's outstanding shares and is commonly used to mesure how much a company is worth. 32 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Apple in the last twelve months. There are currently 1 sell rating, 5 hold ratings, 24 buy ratings and 2 strong buy ratings for the stock.

The consensus among Wall Street research analysts is that investors should "buy" Apple stock. Come 2022, the Federal Reserve is expected to raise interest rates to fight inflation, and government programs meant to stimulate the economy during the pandemic will have ended. Those policy changes will cause investors, businesses and consumers to behave differently, and their actions will eventually take some air out of the stock market, according to analysts. The company generates roughly 40% of its revenue from the Americas, with the remainder earned internationally.

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

While Apple didn't hit the $3 trillion market cap today, its share price remains 200% percent higher than it was prior to the pandemic. The company plans to release computerized glasses featuring augmented reality technology in 2022, and is developing a virtual reality headset as well. Apple is also working on a self-driving electric vehicle that could be on the market as soon as 2025. The iPhone makes up the majority of Apple's total revenue. On the other hand, each product had a noticeably positive effect on the stock over a longer period of time. The overarching, long-term view is the one to properly frame your investment decisions on, not day-to-day volatility.

Over time, the market mechanism will identify true value in the marketplace. Rely on the wisdom of the masses over the long term, not on the speculators that routinely come and go, thereby letting companies like Apple work for you. Before we delve into the product lines, it's important to remember a few key points about Apple's stock history. The company's stock trades on the Nasdaq under the ticker symbol AAPL. As of July 3, 2021, Apple had a market capitalization of $2.34 trillion, closing the trading day at $139.96. Companies like Apple must beat collective market expectations of their earnings to positively influence their market capitalization.

It's no accident that they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices. As a result, earnings management is highly scrutinized by the Securities and Exchange Commission . Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow.

Updated daily, it takes into account day-to-day movements in market value compared to a company's liability structure. Prices for used cars skyrocketed amid a global computer chip shortage. As Covid-19 vaccination rates improved, businesses trying to reopen had to raise wages to attract and retain employees.

Consumer prices climbed 5.7 percent in November from a year earlier — the fastest pace since 1982. Based out of Cupertino, the market capitalization of Apple is $2.... NextBillion Technology Private Limited makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Unless otherwise specified, all returns, expense ratio, NAV, etc are historical and for illustrative purposes only.

Future will vary greatly and depends on personal and market circumstances. The information provided by our blog is educational only and is not investment or tax advice. Enterprise Value is a measure of a company's total value, often used as a more comprehensive alternative to equity market capitalization. Enterprise value includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet.

Market cap or market capitalization is the total market value of all of a company's outstanding shares. Long considered one of the safest tech stocks to invest in, Apple has weathered the pandemic better than many of its competitors thanks in part to its strong cash flow. With new projects on the horizon, some analysts believe its capitalization is likely to climb past $3 trillion by next year, if not sooner. The stock market reflects all known information as stated by the efficient market hypothesis, processing and assimilating new data rapidly through the mechanism of buying and selling.

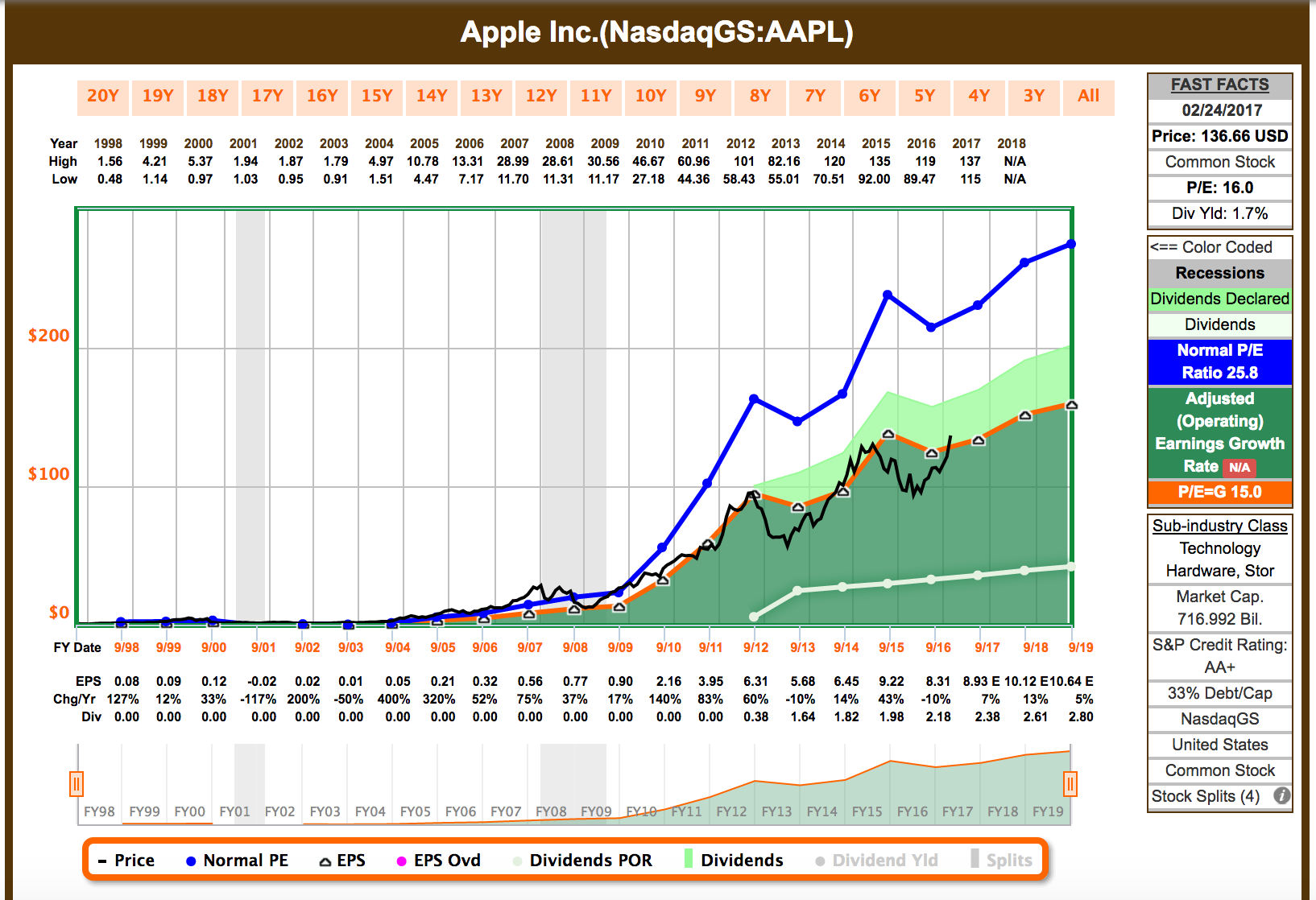

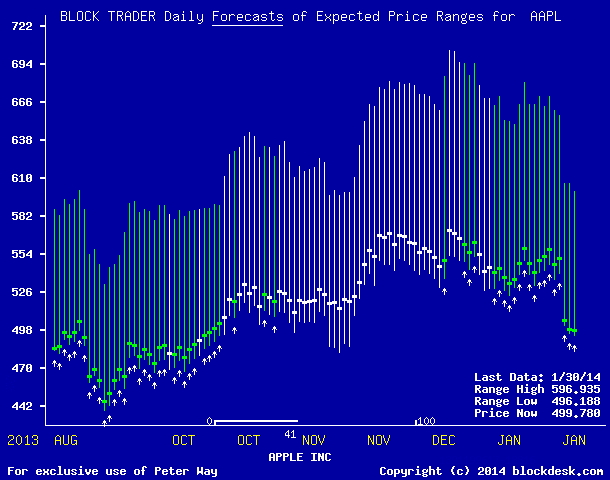

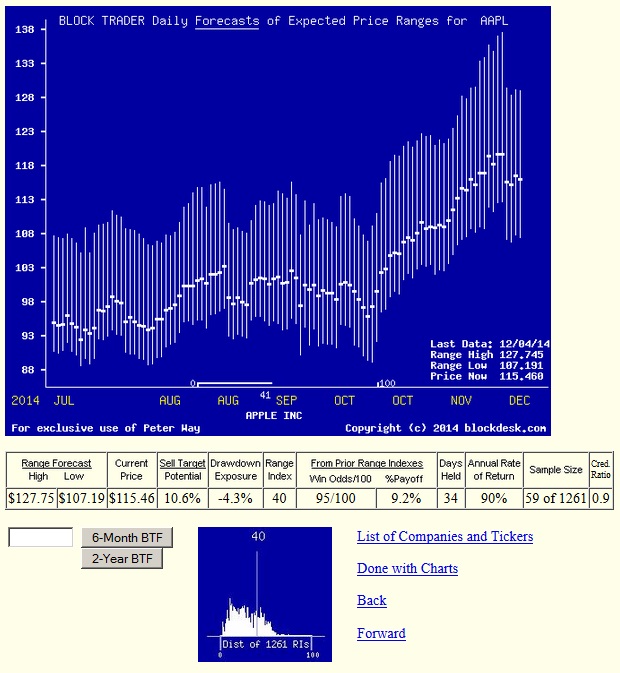

The stock market is also forward-looking, which explains why a company's stock may fall, even when reported earnings improve from the previous quarter. Apple's stock history is a stellar example of how this works. Thanks to the astronomical rise over the years, Apple split the stock again in June 2014, this time seven-for-one.

Three years later, in 2017, with Tim Cook at the helm and a services business providing a bulk of revenue, Apple's stock price is still steadily climbing. The past year also seemed promising at first for new stock offerings, and nearly 400 private companies raised $142.5 billion in 2021. But investors had sold off many of the newly listed stocks on the New York Stock Exchange or Nasdaq by the end of the year. The Renaissance IPO exchange-traded fund, which tracks initial public offerings, is down about 9 percent for the year. Apple has been increasingly counting on selling digital services to drive profitability and stabilize its revenues, which have been somewhat volatile in recent years. Services accounted for about 19% of Apple's total revenues and about 31% of gross profits over its most recent quarter (Q2 FY'21).

Apple has also launched a slew of new service offerings in recent years, ranging from fitness tutorials, paid podcasts, and streaming video. We estimate that the two services revenue streams together accounted for about $23 billion of Apple's roughly $54 billion in services sales last year. Declining interest in other types of investments may be contributing to Apple's popularity as well.

Bond buying has dwindled over the past year as interest rates remain low; at the same time, Apple now tends to outperform such investments. In November, for example, Apple stock had returns of 5.6% while BlackRock's US government bond exchange-traded fund reported returns of just 1.17%. There have been few Apple product releases that immediately resulted in a meteoric rise in the company's stock price. Day traders are known to target Apple at the release of each of its products, but the quick riches that they seek are all too often a mirage that swiftly disappears.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.